Welcome to Our Blog

Tech CU’s thoughts and insights about topics of interest.

Saving Money Amid Covid-19

Saving Money Amid COVID-19

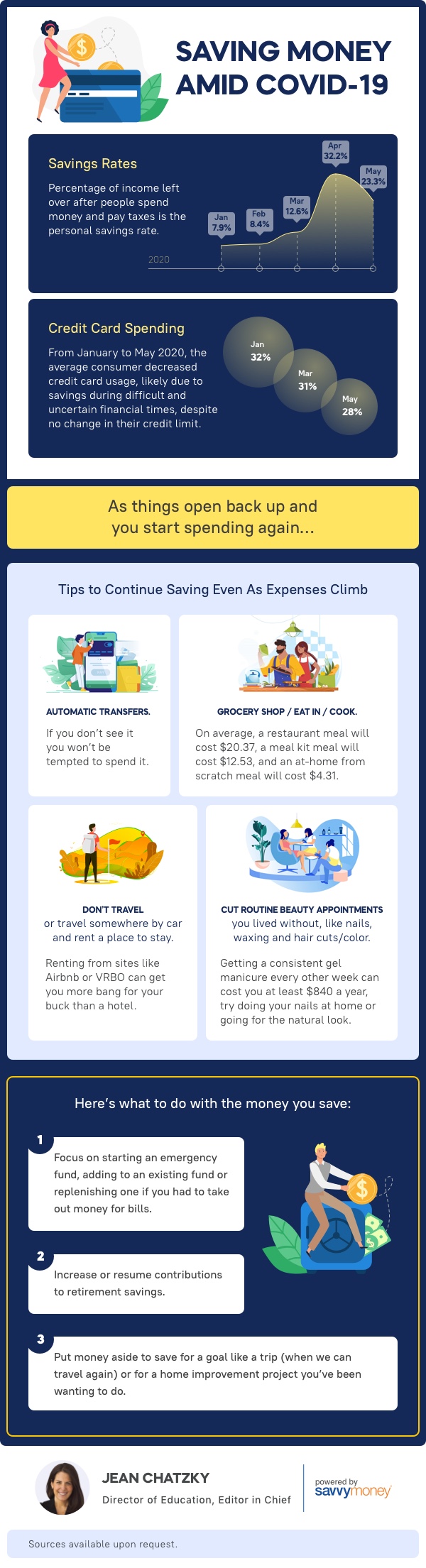

Saving Rates

Percentage of income left over after people spend money and pay taxes is the personal savings rate.

2020: Jan 7.9%, Feb 8.4%, Mar 12.6%, Apr 32.2%, May 23.3%

Credit Card Spending

From January to May 2020, the average consumer decreased credit card usage, likely due to savings during difficult and uncertain financial times, despite no change in their credit limit.

Jan 32%, Mar 31%, May 28%

As things open back up and you start spending again…

Tips to Continue Saving Even As Expenses Climb

Automatic Transfers.

If you don’t see it you won’t be tempted to spend it.

Grocery / Eat in / Cook.

On average, a restaurant meal will cost $20.31, a meal kit will cost $12.53, and an at-home from scratch meal will cost $4.31.

Don’t Travel

or travel somewhere by car and rent a place to stay.

Renting from sites like Airbnb or VRBO can get you more bang for your buck than a hotel.

Cut Routine Beauty Appointments

you lived without, like nails, waxing and hair cuts/color.

Getting a consistent gel manicure every other week can cost you at least $840 a year, try doing your nails at home or going for the natural look.

Here’s what to do with the money you save:

- Focus on starting an emergency fund, adding to an existing fund or replenishing on if you had to take out money for bills.

- Increase or resume contributions to retirement savings.

- Put money aside to save for a goal like a trip (when we can travel again) or for a home improvement project you’ve been wanting to do.

Jean Chatzky

Director of Education, Editor in Chief

Powered by SavvyMoney

Sources available upon request.

Back to Blog